Close

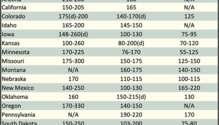

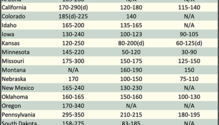

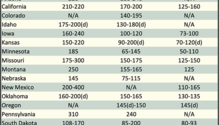

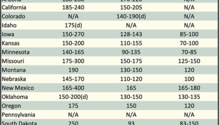

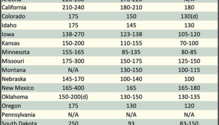

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of th

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of the

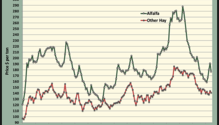

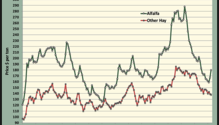

After peaking at $191 per ton in May, the average price for alfalfa dropped by $18 per ton during June and July. According to the USDA’s Agricultural Prices report, alfalfa fell to $173 per ton,

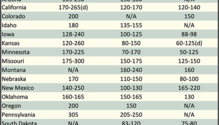

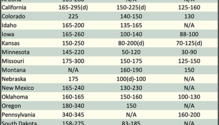

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of th

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of the

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end

After three consecutive months of upward price movement, the average alfalfa hay price retreated quickly during June. According to the USDA’s Agricultural Prices report, alfalfa fell to $177 per

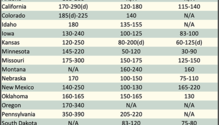

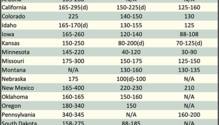

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end o

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of th

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end

We hadn’t seen a consecutive three-month jump in average alfalfa prices since February through April 2023, but that changed with the recent USDA’s Agricultural Prices report that showed another

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of th

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of th

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of th

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of the

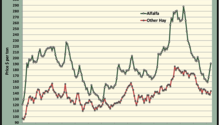

For many years, the annual hay price trend was predictable. Such has not been the case for the past couple of years. Prices either headed up or down for the entirety of the year, regardless of the mon

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of the

In their annual inventory of the collective U.S. haymow, USDA pegged May 1 hay stocks at nearly 24.1 million tons, which was up by nearly 3.1 million tons (15%) from the previous year. This follows a

..

Visit our partner publications:

Hoard's Dairyman | Journal of Nutrient Management