Hay exports tumbled in 2023 |

| By Amber Friedrichsen, Associate Editor |

|

|

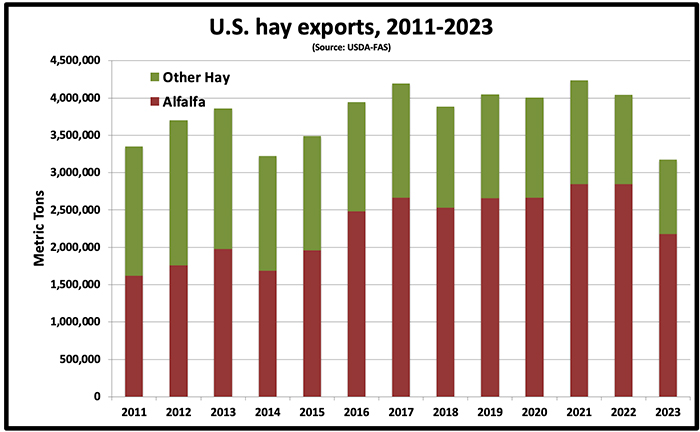

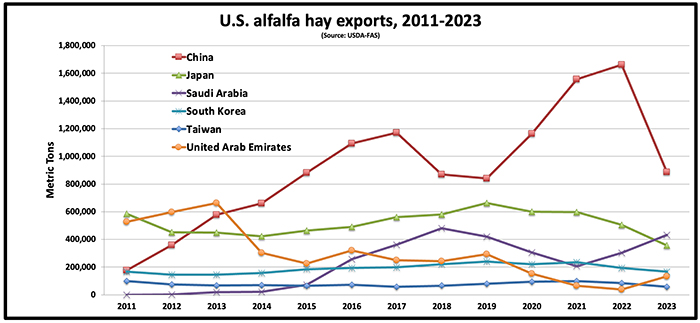

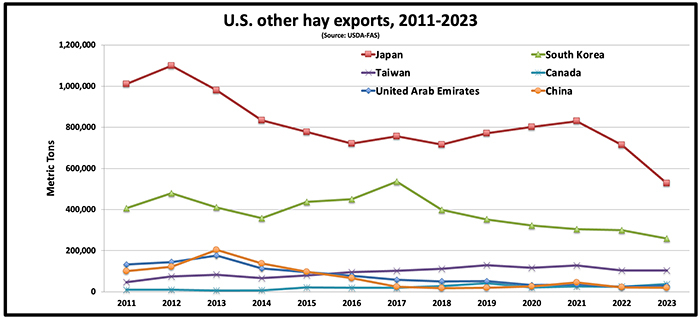

Hay exports in 2023 totaled 3.171 million metric tons (MT), which was down 22% from the 4.04 million MT exported in 2022. According to data from the USDA’s Foreign Agricultural Service (FAS), it was also the first time in five years total hay exports fell below 4 million MT. Declines in both alfalfa and nonalfalfa hay exports contributed to the drop in total export sales. An aggressive exchange rate is largely to blame for top export markets holding back on U.S. hay, as well as low milk prices in other countries and less international trade in general.  Alfalfa at a loss The USDA-FAS reported alfalfa hay exports to all trade partners totaled 2.177 million MT in 2023, which is down nearly 22% from the record high of 2.847 million MT set in 2022. China remained at the top of the charts among U.S. alfalfa hay export markets with 886,661 MT, although this was 774,104 MT, or 47%, less than the previous year. Alfalfa hay exports to China represented about 40% of total U.S. alfalfa hay exports in 2023, which is also down from the 57% majority share that the country claimed in 2022. Exports to China were off to a shaky start in 2023, hitting their lowest point in July at 44,211 MT, before the country began importing more alfalfa hay month-over-month through the end of the year. China rounded out December by importing 112,407 MT of U.S. alfalfa hay, marking the first month of 2023 that its import volume exceeded 100,000 MT. Scot Courtright, who oversees logistic operations and international sales at Courtright Enterprises, an export company based in Washington State’s Columbia Basin, said two major factors for China’s lower import volume of alfalfa hay in 2023 was the country’s weakened economy and low milk prices. The narrative flipped from the previous year when high-quality alfalfa hay was in high demand from Chinese dairies. Now, an oversupply of milk is motivating farmers to produce less, and therefore feed less, despite lower hay prices. Since 2014, Japan has trailed China as the second highest importer of U.S. alfalfa hay, but this was not the case in 2023. Saudi Arabia’s 431,400 MT of alfalfa hay imports surpassed Japan’s 356,504 MT. This is a 42% jump from Saudi Arabia’s alfalfa hay imports in 2022, and it is more than double the alfalfa hay the country imported in 2021. Courtright said Saudi Arabia recently implemented irrigation regulations on crops for nonhuman consumption, which likely explains the surge in alfalfa hay exports to the desert country. Conversely, Japan’s 29% year-over-year decline in alfalfa hay imports was mostly driven by an unfavorable exchange rate between the U.S. dollar and the Japanese yen. South Korea was the fourth largest alfalfa hay export market for the second consecutive year with 166,191 MT; however, the country’s total alfalfa imports for 2023 were down 27,946 MT, or 14%, from 2022. Close on its heels was the United Arab Emirates (UAE) to round out the top five U.S. alfalfa hay importers with a total of 132,252 MT. The UAE traded spots with Taiwan with a staggering 251% uptick in U.S. alfalfa hay imports compared to 2022 when the desert country hit a nine-year low at 37,659 MT. According to Courtright, the UAE has implemented similar irrigation regulations as Saudi Arabia. He predicts other desert countries will follow suit, which may open doors to a more diversified export market moving forward, especially if competition with China is reduced.  Other hay hit a low Hay exports other than alfalfa (mostly grass) totaled 994,000 MT in 2023. Based on data from the USDA-FAS, this was 17% less than the nearly 1.2 million MT of grass hay that was exported in 2022, and it was the first time in well over a decade that U.S. grass hay exports dipped below 1 million MT. Japan maintained its long-held lead as the top importer of U.S. grass hay with 528,061 MT, but this was almost 26% less than the adjusted value of 713,193 MT it imported in 2022. Like the country’s alfalfa hay imports, Japan’s grass hay imports were hindered by exchange rate implications, which encouraged more domestic forage production and transport. Grass hay exports to South Korea also took a dive in 2023, falling more than 13% year-over-year to settle at 258,722 MT. This is the country’s sixth consecutive year of decline for U.S. grass hay imports. Exports to Taiwan, the third-leading export market for nonalfalfa hay, were relatively unchanged in 2023 at 103,110 MT. Canada and the UAE rounded out the top five U.S. grass hay export markets with 36,902 MT and 28,932 MT, respectively. The countries were also the only two of the top export markets that saw a rise in U.S. grass hay demand. Canada upped its imports by 38% and the UAE by 23%. After importing 52% less U.S. grass hay from 2021 to 2022, China ranked even lower on the leader board with another 10% decline in 2023, settling at 19,057 MT.  Summary In 2023, the strength of the U.S. dollar had a significant negative impact on the largest export markets for alfalfa and nonalfalfa hay. The few positive moves from smaller importers of either product were not enough to offset the volumes lost to discouraging exchange rates. Total U.S. hay exports fell below 4 million MT for the first time in five years, with China’s 47% cutback in U.S. alfalfa hay having the greatest influence on the decline. And while the country continues to dominate the U.S. hay export market, China’s share of U.S. alfalfa hay exports fell from 57% to 40% in 2023. According to USDA data from 2023, total hay exports comprised less than 3% of all hay production across the U.S., and slightly more than 4% of our country’s alfalfa hay was shipped overseas. Although these percentages are small, export sales make up a much more prominent portion of the Western hay market. Josh Callen, author of The Hoyt Report, is privy to the effects the environment of the export market has had on states like Arizona, California, Idaho, Nevada, Oregon, Utah, and Washington. Hay prices in regions like the Pacific Northwest and the Imperial Valley have drastically declined in response to low export sales that Callen confirmed were largely killed by adverse exchange rates last year. |