Hay exports flatlined in 2024 |

| By Amber Friedrichsen, Managing Editor |

|

|

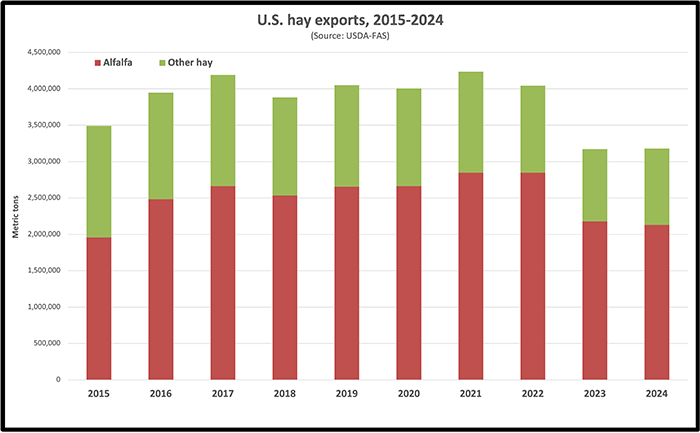

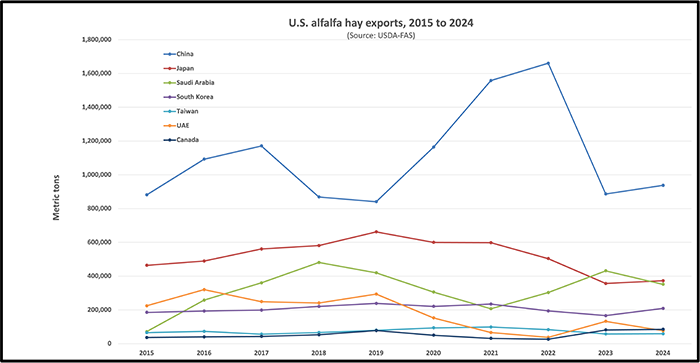

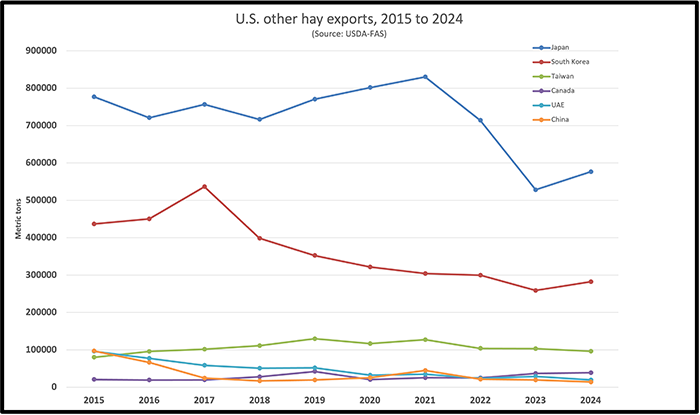

Hay exports in 2024 totaled 3.179 million metric tons (MT). According to the USDA’s Foreign Agricultural Service (FAS), this was down less than 1% from the previous year. Despite a strong start to the year with exports through May up 25% year-over-year, demand trailed year-ago levels every month during the second half of the 2024 to balance the scales of the final estimate. A decline in alfalfa hay exports contributed to the drop in total exports, whereas nonalfalfa hay exports had a double-digit increase year-over-year. Diminishing milk prices in major hay importing countries, the strength of the U.S. dollar, and competition from a greater number of global suppliers are the primary factors for the current climate of the export market.  Alfalfa fell behind At 2.128 million MT, alfalfa hay exports to all trade partners were down about 3% in 2024. This followed a steep decline in sales reported the previous year when alfalfa hay exports fell 22% from the record high 2.847 million MT set in 2022. China imported a total of 937,447 MT of U.S. alfalfa hay in 2024. This was up almost 6%, or 50,786 MT, compared to 2023. It also represented about 44% of total alfalfa hay exports, although this was still down significantly from the 57% majority market share China claimed in 2022. March was the biggest month for alfalfa hay exports to China with 109,861 MT. Other strong months included January, February, April, July, and December, in which alfalfa hay exports were all over 80,000 MT. Despite the uptick, U.S. exporters have been prudent to the 40-month slide in Chinese milk prices. At the California Alfalfa & Forage Symposium last December, Scot Courtright with Courtright Enterprises explained that roughly 60% of the of the Chinese dairy industry was unprofitable in 2023, and that number jumped to 80% in 2024. As producers there continue to reduce their herd size, it’s unlikely alfalfa exports to China will recover to the record-high demand seen a few years ago. Courtright also noted Chinese-owned companies based in the U.S. negatively influence export volume. When hay grown in the U.S. is funneled through these companies, it is inaccessible to U.S. exporters. While this doesn’t necessarily impact hay growers, it does skew export market data. Japan edged out Saudi Arabia as the second-largest alfalfa hay export market last year, reclaiming the spot on the leaderboard it had previously held since 2014. Exports to Japan totaled 372,858 MT in 2024, which was up roughly 5% from 2023. A close third, Saudi Arabia imported 351,258 MT of U.S. alfalfa hay, which was down over 24% year-over-year. Exports to South Korea saw a 26% spike in 2024 at 209,054 MT, maintaining its slot as the fourth-largest U.S. alfalfa hay market. The United Arab Emirates slid to sixth place with a more than 42% decline in alfalfa hay demand at 76,932 MT. This was bested by Canada to round out the top five, which imported 82,208 MT of U.S. alfalfa hay last year.  Other hay on the rise Hay exports other than alfalfa (mostly grass) totaled 1.051 million MT in 2024. Based on data from USDA-FAS, this was roughly 6% greater than the 995,748 MT of grass hay that was exported to all trade partners in 2023. The same export markets maintained their top five positions. Once again, Japan imported the lion’s share of U.S. grass hay at 576,294 MT, comprising over 54% of the overall market. This was also up about 9% year-over-year. With that said, Japan’s buying power was limited throughout 2024 for the same reason it was the year prior: a steep exchange rate between the U.S. dollar and the Japanese yen. Grass hay exports to South Korea climbed more than 8% to settle at 282,149 MT in 2024, reversing the country’s seven-year downward trend in demand. At the California Alfalfa & Forage Symposium, Courtright stated trade dynamics with South Korea appear relatively healthy despite political turmoil in the Asian country. The third-largest grass hay export market was Taiwan with 96,087 MT, although this was nearly 7% less year-over-year. Canada and the United Arab Emirates (UAE) remained the fourth- and fifth-largest U.S. grass hay export markets with 38,755 MT and 19,234 MT, respectively. Although exports to Canada saw a 4% increase year-over-year, demand from the UAE fell roughly 33%. In contrast from its alfalfa hay demand, China only imported 13,942 MT of U.S. grass hay in 2024, and this was about 25% less than what it imported in 2023.  Summary Although overall U.S. hay exports were somewhat stronger in 2024, they were discouraged from even greater growth because of lower demand for alfalfa from our biggest international customers. The best example of this is in China, where the large gap between last year’s alfalfa hay sales and the record-high volume shipped in 2021 was heavily influenced by the country’s failing dairy industry. On the other hand, South Korea seems to be a bright spot for alfalfa hay exports. In fact, in last week’s Hoyt Report, author Josh Callen noted that when demand waned in China, exporters were able to redirect hay to South Korea, where customers responded favorably. U.S. grass hay exports rebounded above 1 million MT after dipping below this level for the first time in five years in 2023. This was helped by greater exports to Japan, but tension remains within this trade dynamic as a challenging exchange rate continues to exist between the two countries. Even more tension is looming across all trade dynamics given the uncertainty about tariffs proposed by the Trump administration. According to USDA data from 2024, total hay exports comprised less than 3% of all U.S. dry hay production. Even though this is a relatively small percentage nationwide, export sales make up a much more prominent portion of the Western hay market and thus play a larger role in Western hay prices. Callen has expressed that while the market in states like Arizona, California, Idaho, Nevada, Utah, Oregon, and Washington has stalled in recent years, there are signs that hay prices in these regions have likely bottomed out and may begin to climb as the growing season begins. |