Close

USDA launched its Crop Production Annual Summary yesterday, which contains final numbers for hay production, acreage, and average yields in 2025.According to the report, forage production was relative

Carson Roberts is determined to convince beef producers to stop making hay. In a recent episode of the I-29 Moo University forage webinar series, the state forage specialist with the University of Mis

Few sights capture rural life quite like hay bales dotting a golden field beside a red barn. It’s a postcard image of hard work and harvest. But for those who grow, haul, and sell hay, the bales

I have never been a fan of flashy cars or used car salesmen. My first car was a green 2005 Ford Taurus with a huge dent in the passenger door

“Slop” is the 2025 Word of the Year, according to Merriam-Webster. The mainstream media’s definition of slop probably isn’t what comes to farmers’ minds when they hear the

The National Alfalfa & Forage Alliance (NAFA) released the 2026 edition of its popular “Alfalfa Variety Ratings - Winter Survival, Fall Dormancy & Pest Resistant Ratings for Alfalfa Varietie

The colder months ahead require farmers to winterize hay equipment, take inventory of stored forages, and draw up plans to feed livestock. As we wrap up forage production for 2025, it’s a good time

There are few businesses that I appreciate more than a trusty convenience store. The best ones are located right along the highway or near an offramp to minimize detours. They earn my repeat business

After a year of somewhat tighter availability of certain key alfalfa varieties, 2026 will offer a better overall supply of alfalfa

Though the calendar isn’t always a reliable resource to determine planting dates and harvest schedules, many farmers have an idea where their annual activities typically fall within those 12 pages

A balanced uptake of nutrients allows plants to thrive. Potassium (K) is one of the three primary nutrients, along with nitrogen and phosphorus, that is often applied in the greatest quantities. But how

Farmers can add weed control to the long list of benefits gained from growing alfalfa in crop rotations. According to Mark Renz, being a dense stand of perennial forage that is cut several times a year

Have you ever seen a forage analysis report where the concentration of acid detergent fiber (ADF) in a forage sample was similar or even greater than the concentration of neutral detergent fiber (NDF)?

Kelsey Woldt is the oldest of the five daughters who were born and raised on Woldt Farms in Brillion, Wis. Now serving as the farm’s human resources manager, Woldt and her sisters have all been invo

After 13 years of working in extension, I can say that the only constant is change. The same can be said about our weather

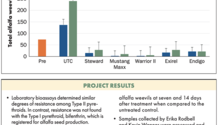

When adult alfalfa weevils began appearing earlier than usual in Montana fields, agricultural researchers took notice

When you turn your smartphone on “do not disturb” mode, it quiets all activity, from texts to calls and other app notifications. It won’t ring, vibrate, or even light up the screen, which

Bruce Lackman hasn’t always rotationally grazed his cattle. It wasn’t a widely adopted practice when he was growing up, and it still isn’t popular in his region of central Missouri today

Is your alfalfa lacking persistence? Have you experienced a high frequency of winterkill in the past? Are your stands susceptible to insect damage and disease pressure? If you answered “yes”

..

Visit our partner publications:

Hoard's Dairyman | Journal of Nutrient Management