Close

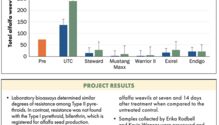

When adult alfalfa weevils began appearing earlier than usual in Montana fields, agricultural researchers took notice

When you turn your smartphone on “do not disturb” mode, it quiets all activity, from texts to calls and other app notifications. It won’t ring, vibrate, or even light up the screen, which

Is your alfalfa lacking persistence? Have you experienced a high frequency of winterkill in the past? Are your stands susceptible to insect damage and disease pressure? If you answered “yes”

Kiowa County, Kansas, contains 1,800 people, three incorporated communities, and one traffic signal

Just like haymaking and grazing rotations are seasonal in nature, so too is the work of an agricultural journalist — especially those of us in the hay and forage business. As farmers enter hayfields

Everyone has their opinions on how to best seed cool-season grasses and legumes for successful establishment. Variables include factors such as planting rate, type of drill or seeder, weed control met

To optimize something is to make the best or most effective use of it. Rather than maximizing one aspect of a resource or minimizing its worst part at the expense of all others, optimization finds the

As the story goes, David Mulligan hit a poor drive off the first tee at a Montreal golf course. The errant shot may or may not have been the result of an extremely bumpy ride while travelling to the m

Trade-offs already exist between spring seedings and late summer seedings before planting management is added to the mix. The latter time frame often boasts more favorable weather and field conditions

The National Alfalfa & Forage Alliance (NAFA) announced last month that alfalfa will now be included as a short-term perennial option in the USDA’s Natural Resources Conservation Service (NRCS) 328

Almost every phone call home turns into an extensive update of the goings-on at my family’s farm. The latest conversation with my dad about the approaching planting season, for example, landed

Making dry hay when weather conditions are uncooperative can be extremely frustrating

USDA launched its Crop Production Annual Summary last Friday, detailing the previous years’ hay production, acreage, and average yields. According to the report, the nation’s forage productio

Alfalfa has a lot of impressive features when it comes to water usage. And despite being a major water user, alfalfa is also a major food producer. At least, that is how Dan Putnam defended the number

As the sun sets on most hayfields for the season, USDA’s October Crop Production report predicted alfalfa and alfalfa-mixed hay production to be up 8% from last year

When I started working at Hay & Forage Grower, I got a front-row seat to all things alfalfa, from baling hay and chopping haylage to plant genetics and seed marketing. Little did I know I th

World Dairy Expo is known as the meeting place for the global dairy industry. It’s also an event for haymakers from across the country to come together and learn about the latest equipment, test

To cut, or not to cut. That is the question Hamlet would ask if only he were a forage producer and not a Shakespeare character. More specifically, the question would be to give alfalfa a longer rest a

What comes to mind when you think about the fall of 2021? Is it the incredibly high fertilizer prices that more than doubled year-over-year? Or maybe it’s extremely sluggish supply chains for parts

When it’s time to harvest alfalfa for silage or hay, we are usually concerned about getting the crop cut at the right time, hitting weather windows for good drying conditions, and removing the crop

..

Visit our partner publications:

Hoard's Dairyman | Journal of Nutrient Management