Close

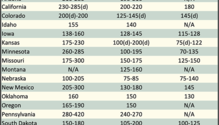

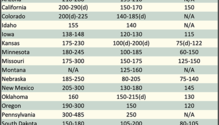

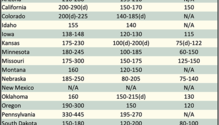

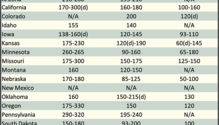

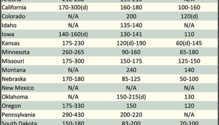

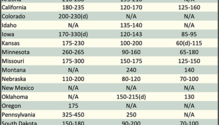

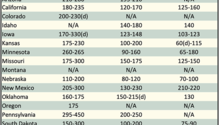

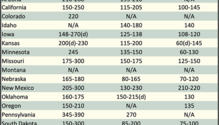

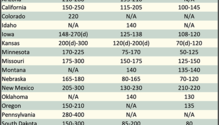

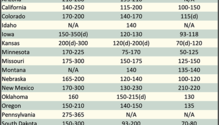

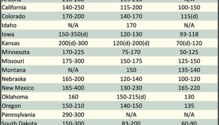

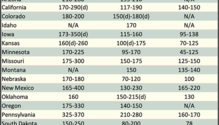

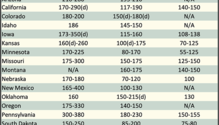

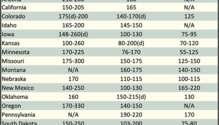

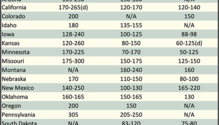

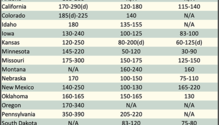

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of the

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of th

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of the

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of th

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the e

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end o

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of th

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of the

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end o

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of th

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of the

After peaking at $191 per ton in May, the average price for alfalfa dropped by $18 per ton during June and July. According to the USDA’s Agricultural Prices report, alfalfa fell to $173 per ton,

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of th

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of the

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end

..

Visit our partner publications:

Hoard's Dairyman | Journal of Nutrient Management