May 6, 2025

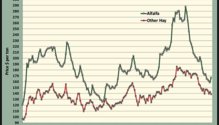

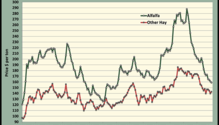

It is difficult to discern what direction, if any, hay prices are headed based on data from USDA’s Agricultural Prices report for March. The average price of alfalfa hay jumped by $8 per ton compare...

May 6, 2025

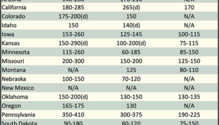

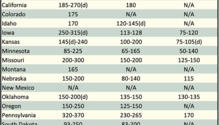

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of the...

April 29, 2025

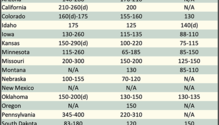

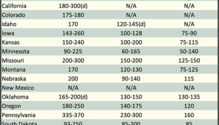

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of the...

April 22, 2025

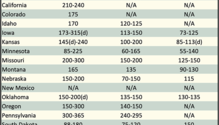

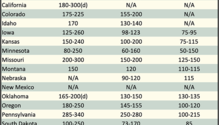

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of the...

April 15, 2025

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of the...

April 8, 2025

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of the...

April 1, 2025

The average price for alfalfa hay was down another $2 in February at $159 per ton, which was $42 less than last year and the lowest such price recorded since February 2018. Data from the USDA’s Agri...

April 1, 2025

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of the...

March 25, 2025

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of the...

March 18, 2025

Below are examples of alfalfa and grass prices being paid FOB barn/stack (except for those noted as delivered, which are indicated by a "d" in the table below) for selected states at the end of the...

Visit our partner publications:

Hoard's Dairyman | Journal of Nutrient Management