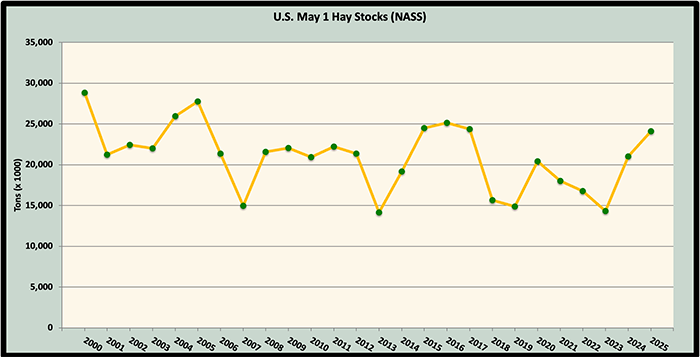

In their annual inventory of the collective U.S. haymow, USDA pegged May 1 hay stocks at nearly 24.1 million tons, which was up by nearly 3.1 million tons (15%) from the previous year. This follows a 47% inventory boost from May 2023 to May 2024.

This past December, year-over-year hay stocks jumped by over 4.8 million tons.

The recent May 1 hay stocks estimate is the highest reported since 2017 when the nation’s hay inventory totaled nearly 24.4 million tons.

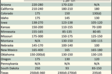

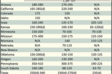

Some of our largest hay-producing states had significant year-over-year May 1 stock gains (see table below). Those with the largest increases included:

Wisconsin: up 167%

Minnesota: up 146%

Texas: up 100%

Missouri: up 85%

Nebraska: up 84%

Conversely, there were also some major hay-producing states that experienced notable inventory reductions, mostly because of drought conditions last year. This group included:

New Mexico: down 55%

West Virginia: down 54%

Ohio: down 47%

Idaho: down 41%

Arizona: down 40%

Hay disappearance

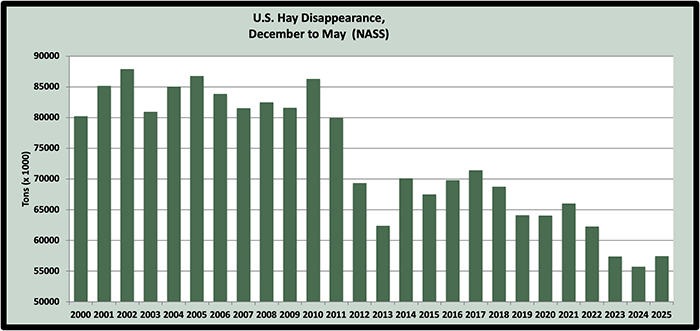

Hay disappearance (primarily feeding) between December 1, 2024, and May 1, 2025, totaled 57.4 million tons. This was about 1.7 million tons more hay fed than the previous year’s record low hay disappearance (see graph).

Prior to the 2011 and 2012 drought years, disappearance from hay barns and stacks was always in the 80 million to 85 million tons range. Since 2012, it’s been rare to have a year where disappearance exceeded 70 million tons. During six of the past seven years, hay feeding has been under 65 million tons.

Looking ahead

Since the record-low May 1 hay stocks year of 2023, barns and stacks have swelled by nearly 10 million tons.

As is always the case, weather and water availability will dictate where hay yields and prices head, but at this point, there is no indication that we will see significant price movement in the coming months.

Low commodity prices make hay-competitive feeds cheaper. Beef prices are expected to stay strong in the foreseeable future, while milk prices look to be in a hold pattern. Strong beef prices are tempering U.S. herd growth, although there has been steady but marginal growth in the nation’s dairy herd. In other words, we can’t expect significantly more mouths for feeding hay to in 2025.

Hay crop input prices have gone up substantially over the past several years, but some of those, too, have moderated. Fertilizer remains a wild card. Prices are higher than a year ago and the recent tariff threats haven’t helped the situation. Hay growers will need to remain diligent in knowing their costs of production as hay prices are in a depressed holding pattern.

Hay export volumes during the first quarter of the year are down from 2024, which depresses competition for Western hay.

All totaled, it’s reasonable to expect that 2025 hay prices will remain steady unless some widespread weather event such as drought tightens down supply, dries up pastures, and boosts demand.

Finally, let’s not forget the two hay market mantras that hold true every year. First, high-quality hay always sells for a premium price and costs no more to make than poor-quality hay. Making quality hay is the quickest way to widen profit margins.

Second, hay markets are largely a regional phenomenon. Local weather conditions and predominant enterprise types (dairy, beef, or equine) will ultimately dictate the demand and price for hay.