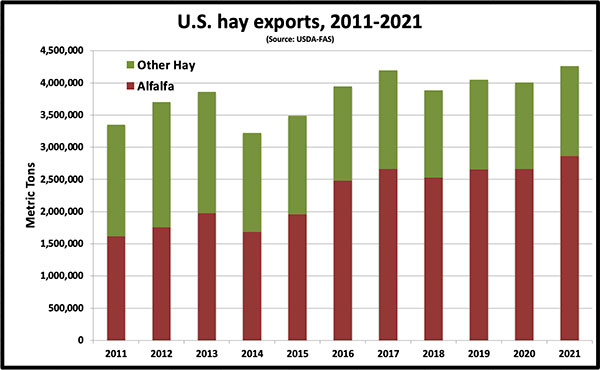

Although logistic challenges were plentiful in 2021, hay exports during the year totaled 4.26 million metric tons (MT), eclipsing the previous record of 4.19 million MT set in 2017. For the third consecutive year and the fourth time in five years, total U.S. hay exports in 2021 exceeded 4 million MT based on data provided by USDA’s Foreign Agricultural Service (FAS). This record-setting trend continues thanks to China’s demand for high-quality U.S. alfalfa hay.

Figure 1.

A thirst for U.S. alfalfa

Alfalfa hay exports to all trade partners in 2021 totaled a record 2.86 million MT, exceeding the previous high-water mark of 2.66 MT in 2020 by 196,100 MT.

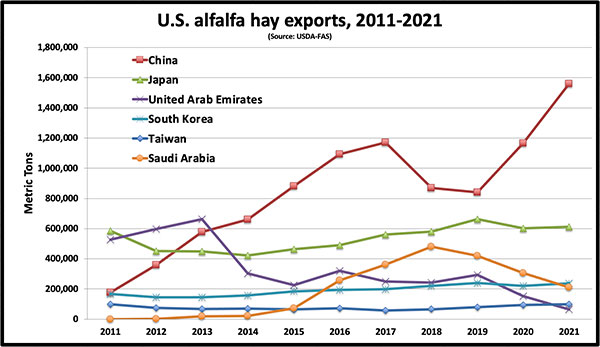

With China’s growing dairy industry and their demand for high-quality alfalfa hay, that country set a new annual record for alfalfa hay imports from the United States for the second year in a row (see Figure 2). The fear that China wouldn’t return to the U.S. following some high-tariff months during 2019 certainly hasn’t come to fruition. In fact, just the opposite has occurred.

In total, China imported 1.56 million MT of U.S. alfalfa during 2021, eclipsing its previous high set in 2017 by over 389,000 MT. Alfalfa hay exports to China last year were 34% (395,000 MT) above 2020. The country now accounts for nearly 55% of all alfalfa hay exports leaving U.S. ports. Monthly export totals to China during 2021 ranged from 65,409 MT in January to an all-time monthly record high of 191,267 MT in August.

China is clearly the major driver for enhanced alfalfa hay exports and, for that matter, all hay exports. In 2021, alfalfa hay exports to China accounted for nearly 37% of all U.S. hay exports, regardless of type. This is great news for Western haymakers as long as the two trade partners remain amiable with each other and China continues to grow its dairy industry.

Concerning the U.S.’s major hay-trading partners not named China, the news is mixed. Japan, the second highest importer of U.S. alfalfa hay, finished the year by purchasing 612,692 MT of U.S. alfalfa, up 2% from 2020.

South Korea moved in front of Saudi Arabia during 2021 for importing the third highest quantity of U.S. alfalfa, finishing the year with 237,900 MT and up 8% from 2020. This flip-flop would have been considered inconceivable just two years ago, but the Saudis only imported 210,100 MT of U.S. alfalfa in 2021, about one-half their 2019 total and not close to their record high of 480,888 MT set in 2018.

The reports heard for several years were that a phase-out of alfalfa production in Saudi Arabia to save water would result in the country being a huge importer of U.S. alfalfa. That simply hasn’t come to fruition partly due to the country sourcing alfalfa from other markets.

Rounding out the top five U.S. alfalfa importers in 2021 was Taiwan, which pushed the United Arab Emirates (UAE) out of that position with an import total of 97,790 MT, up 4.6% from 2020. Like Saudi Arabia, U.S. alfalfa export totals to UAE are crashing. That country only imported 65,522 MT in 2021, down 57% from its 2020 total.

Figure 2.

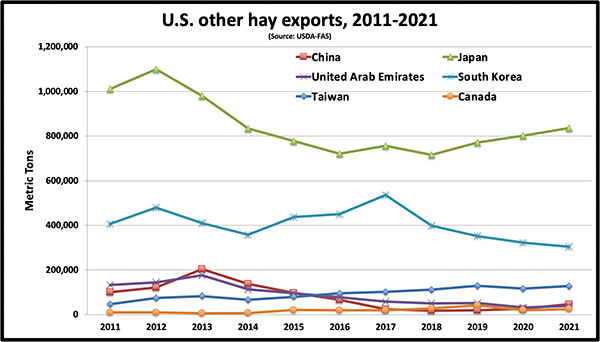

Other hay

USDA-FAS reported 1.4 million MT of hay other than alfalfa was exported from the U.S. in 2021. That was 4.5% more MT than 2020.

Japan leads all export partners for nonalfalfa hay. They imported 835,626 MT in 2021, 4.2% more than the previous year and the third year in a row of volume growth (see Figure 3).

South Korea, a distant second-leading importer of nonalfalfa hay, finished the year with a total of 304,410 MT, which was down 5.4% compared to the previous year, and the country’s fourth year in a row of declining grass hay imports from the United States.

The remaining 2021 top five export trade partners for hay other than alfalfa were Taiwan (127,821 MT, up 9.7%), China (46,671 MT, up 84%), and UAE (38,126 MT, up 18.8%).

Figure 3.

Summary

Despite a plethora of trucking and shipping problems in 2021, hay exports from U.S. ports set numerous volumetric records.

Total hay exports in 2021 exceeded 4 million MT for the fourth time in five years. This was largely due to another big jump in the amount of U.S. alfalfa hay imported by China during the year. The massive Asian country currently accounts for 55% of all alfalfa exported from the U.S.

Hay exports remain a small portion of total U.S. hay production. Based on USDA data for 2021, only 3.9% of all U.S. hay produced and 6.4% of all alfalfa hay entered the export market.

In the seven Western states of Arizona, California, Idaho, Nevada, Oregon, Utah, and Washington, hay exports play a much larger role in impacting both markets and prices.

Based on USDA export and hay production data for those states, nearly 20% of their alfalfa production was exported in 2021 and 33% of the grass production found its way into shipping containers. As such, hay prices in the Western states play a large role in setting market prices.