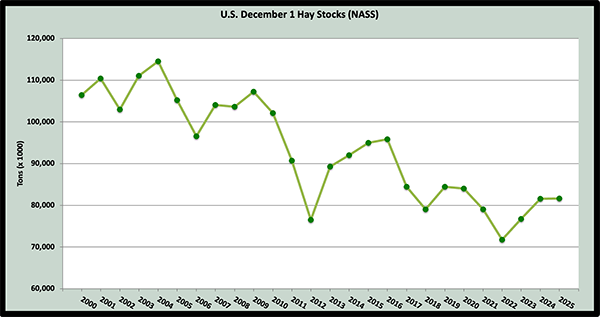

The USDA makes its assessment of dry-hay stocks in May and December of each year. During 2023 and 2024, hay stocks skyrocketed from the record-low level reached in December 2022 and helped cause hay prices to tank.

The news received in yesterday’s Crop Production report proved a bit more encouraging. The report pegged Dec. 1 hay stocks at 81.6 million tons, which was essentially the same as one year ago. Hay prices may not be bolstered by the report, but they also shouldn’t be hindered.

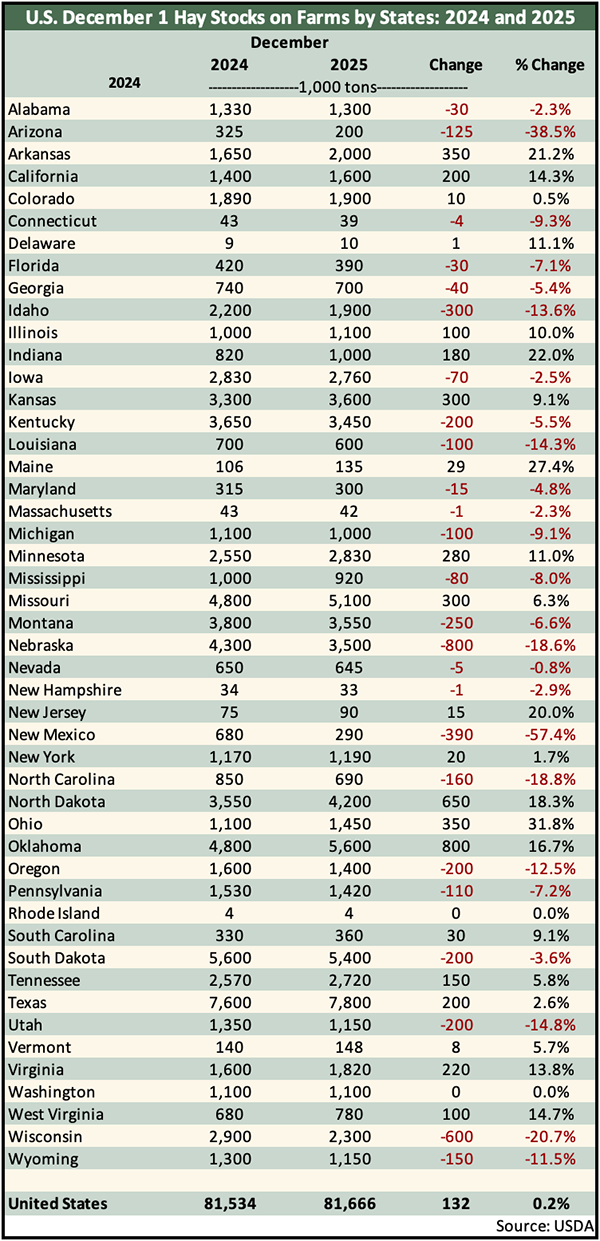

As is always the case, individual states varied in the total amount and direction of year-over-year hay inventory change (see table below). Of the major hay-producing states, most of the largest inventory reductions were rather random, with no region dominating. The largest reductions were seen in:

New Mexico – down 57.4%

Arizona – down 38.5%

Wisconsin – down 20.7%

North Carolina – down 18.8%

Nebraska – down 18.6%

Many states had significant inventory gains. These included several states that experienced drought conditions in 2024 but had an improved growing season in 2025. Some of the largest inventory gains were reported in:

Ohio – up 31.8%

Maine – up 27.4%

Indiana – up 22%

Arkansas – up 21.2%

North Dakota – up 18.3%

The moderation in movement of December hay stocks should help to support hay prices moving forward, especially if the growing season limits overall production. Hay exports continued to struggle in 2025. If that situation turns around in 2026, it will put further pressure on existing hay inventories.

Regional differences in hay supplies almost always exist, and high-quality hay is generally in the shortest supply even where overall inventories appear adequate. That is certainly true this year because frequent rains that occurred early in the growing season made it difficult to get hay harvested on time.

Finally, keep in mind that these inventory numbers do not account for hay stored as higher moisture chopped haylage or baleage.