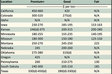

According to the U.S. Census Bureau, U.S. all-hay exports in November totaled 316,061 metric tons (MT), down 7% from last year but up slightly from October. Through November, total hay exports were 3.644,418 MT, down 7% from the same period in 2021. High prices, economic uncertainty, and the strong U.S. dollar continue to weigh on the market.

In China, hay supplies are starting to stack up at the ports and importers have asked U.S. exporters to delay shipments. Domestic milk prices in China are down, and the economy is stalled by the COVID-19 lockdowns and the recent rapid spread of the virus. This means consumers are spending less on dairy products, so dairies are feeding less imported hay in their rations. The government has resisted raising food prices to protect consumers from inflation, which just means the producers are getting squeezed. Exports to China were 128,793 MT, marking the lowest since June.

All-hay exports to Japan were 88,321 MT, down 24% from last year. That marks nine straight months that exports to Japan have been down from the previous year. The outlook for the export timothy hay market continues to look worse. With very light demand, some exporters have started discounting timothy to boost sales. At the current price, exporters are losing money on each shipment. This obviously will have a negative impact on the market for next year. There is going to be more timothy hay carried over into the new year.

Alfalfa hay exports to Saudi Arabia were 42,618 MT, the highest monthly total since March of 2020. With tightening global supplies of hay, Saudi Arabia has started importing more from the U.S. over the past four months. It looks like Saudi Araba will overtake Taiwan and assume the fourth position as the largest importer of U.S. forage products. November was the third straight month that exports to Taiwan were below 10,000 metric tons. Taiwan mainly imports alfalfa and bermudagrass hay from the U.S.